A Deeper Look at Reserves Assignments

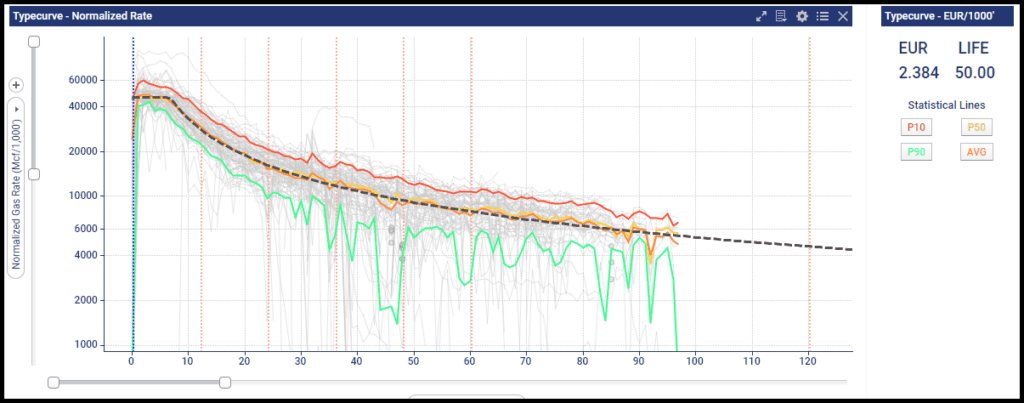

A common question when developing type curves, or more precisely, type well profiles (TWP) and associated EUR (normalized EUR/1000 ft of lateral), is: Why use the P50 (median) to assign reserves? The usual answer is that the median excludes outliers, but this reasoning deserves closer examination.

While it is true that most wells fall between P90 and P10 metrics, does this justify excluding those outside this range when developing a TWP?

The Rationale for Using the P50 in Well Performance Analysis

The preference for the P50 EUR stems from how prudent operators assess well performance and reserves estimation. On the low-performance side, wells experiencing issues—such as frac screenouts, poor water management, or suboptimal early designs—are often excluded. However, high-performing wells are rarely removed, even when their exceptional results cannot be attributed to specific drilling, completion, or operational practices.

This leads to a key question: If ultra-low performers are excluded for valid reasons, should ultra-high performers also be removed? Industry trends suggest that they should be—unless their performance can be directly linked to deliberate engineering choices. This balanced approach ensures a more accurate representation of expected well performance in future developments.

Why Not Use the Average (Mean) EUR Instead of the P50?

If both high and low outliers are removed, some might argue that using the mean EUR would be sufficient. However, in large, statistically distributed datasets, the typical well naturally converges toward the P50 EUR as outliers are minimized.

- Low-end outliers decrease as operators refine completion designs, optimize well spacing, and improve operational efficiencies.

- High-end outliers diminish as development density increases. Early wells (e.g., single wells or two-well pads) benefit from larger drainage areas and higher pressure support, leading to higher EURs. As infill drilling occurs, interference effects increase, reducing the number of extreme high performers over time.

This dynamic varies by basin and development maturity, with some areas normalizing rapidly while others may take years or even decades to reach equilibrium.

The Importance of Dataset Size in Reserves Estimation

The challenge of selecting a representative P50 EUR is magnified when working with small datasets. In large datasets, outliers have minimal impact on the median and may not significantly influence the mean. However, in smaller datasets, performance distribution becomes more critical:

- Limited well counts require greater reliance on geological, petrophysical, and reservoir modeling data to estimate reserves.

- When analogy well counts are low, confidence in reserves assignments naturally decreases.

- In cases of high uncertainty, reserves are often risk-adjusted to account for potential variability.

Conclusion: Why the P50 EUR Remains the Industry Standard

Ultimately, the P50 EUR remains the preferred method for assigning reserves to undeveloped locations based on analogy and historical performance. It provides a realistic, unbiased estimate that reflects typical well performance without being distorted by extreme high or low outliers.

As with any reservoir analysis, technical judgment remains critical in cases where unique geological, operational, or economic factors influence well performance. However, for most type well profile (TWP) assessments, the P50 EUR serves as the most reliable benchmark for reserves estimation.

Please follow us on LinkedIn to stay up to date with the latest industry insights and contact us directly for a tried-and-true evaluation of oil and gas assets, large or small.