Written by Ron Summers

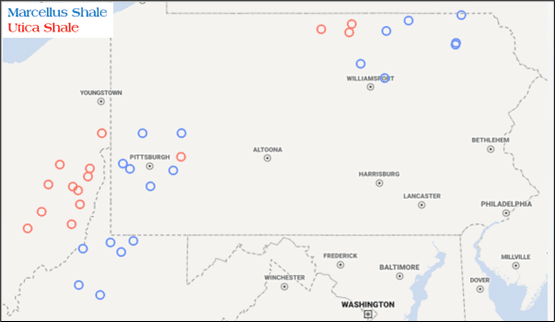

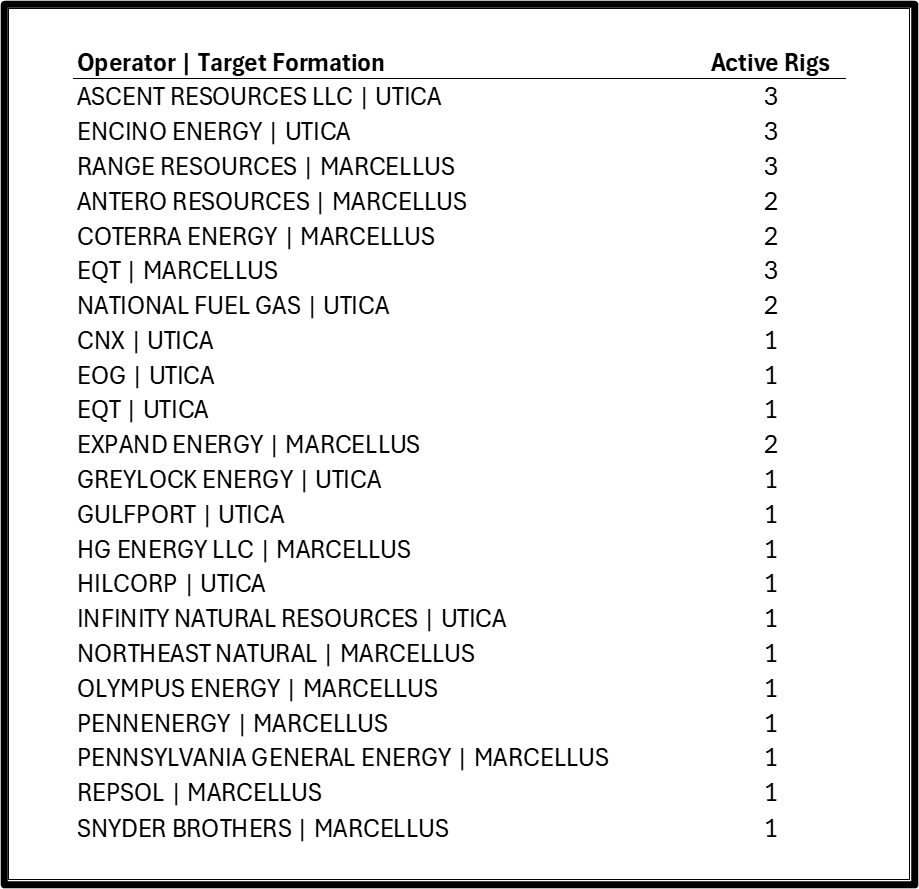

In this brief review we will look at some recent trends in the Marcellus and Utica Shales in the Appalachian Basin. As of June 4, 2025 there were 34 active drilling rigs; 19 targeting the Marcellus and 15 targeting the Utica. Active rig count by Operator and Play is shown in the table below.

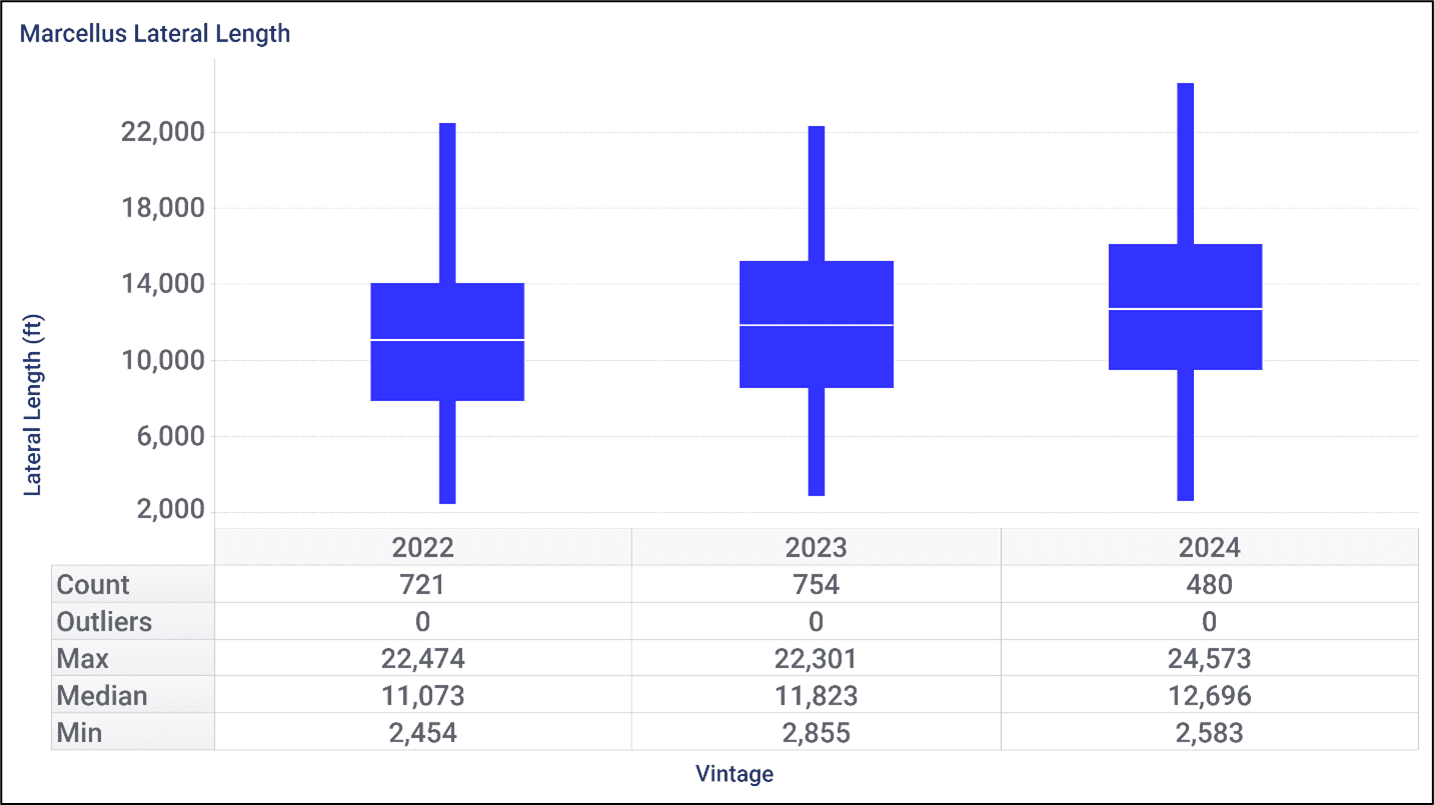

Since 2022, median lateral lengths in both the Marcellus and Utica shales have continued to increase, reflecting ongoing efforts to enhance well productivity and operational efficiency. For the Marcellus, median lateral length increased from approximately 11,100 feet in 2022 to approximately 12,700 feet in 2024.

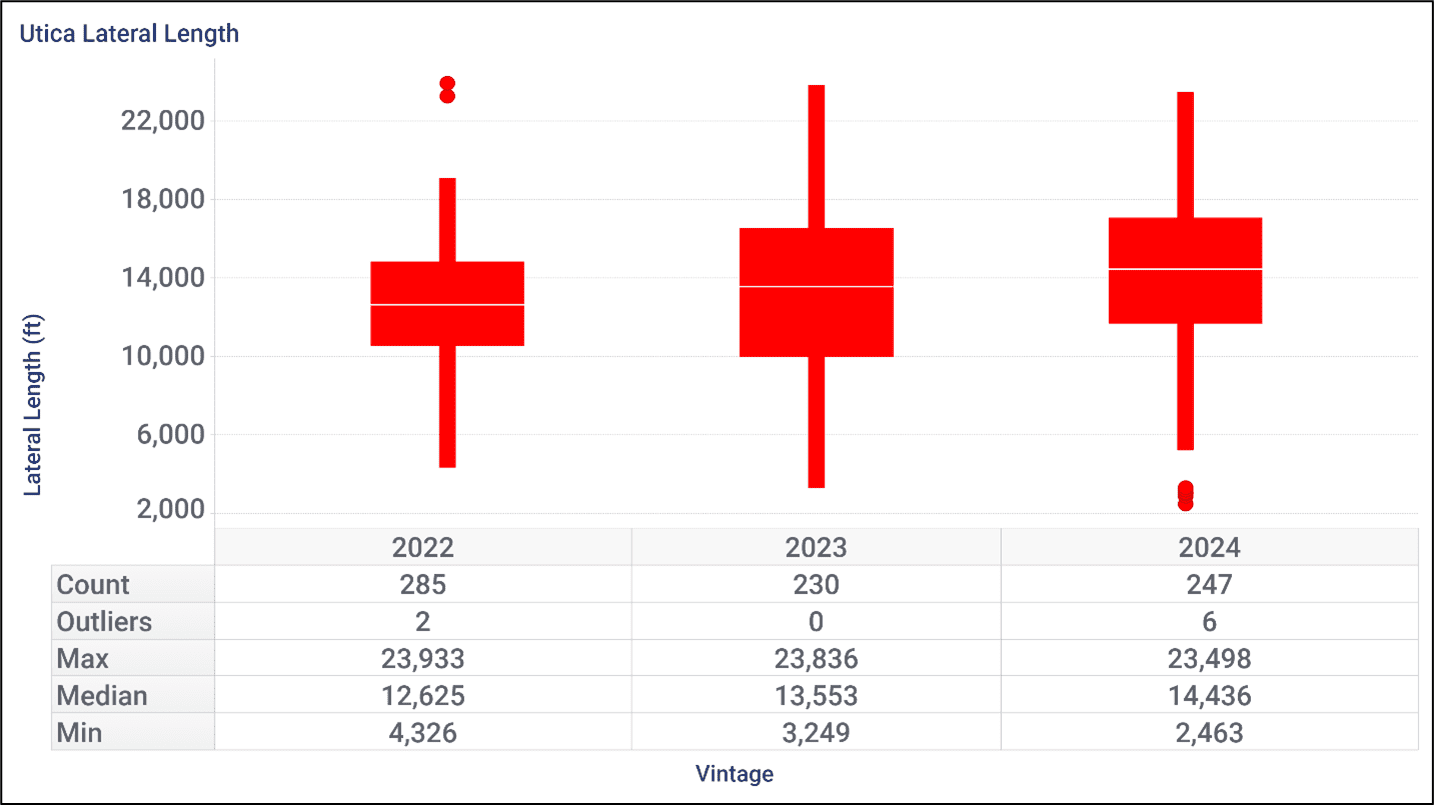

For the Utica, median lateral length increased from approximately 12,600 feet in 2022 to approximately 14,400 feet in 2024.

As seen in the above charts, the maximum drilled lateral length has reached approximately 24,000 feet in both formations. These trends indicate a continued emphasis on extending lateral lengths to maximize resource extraction and improve the economics of Appalachian shale gas development.

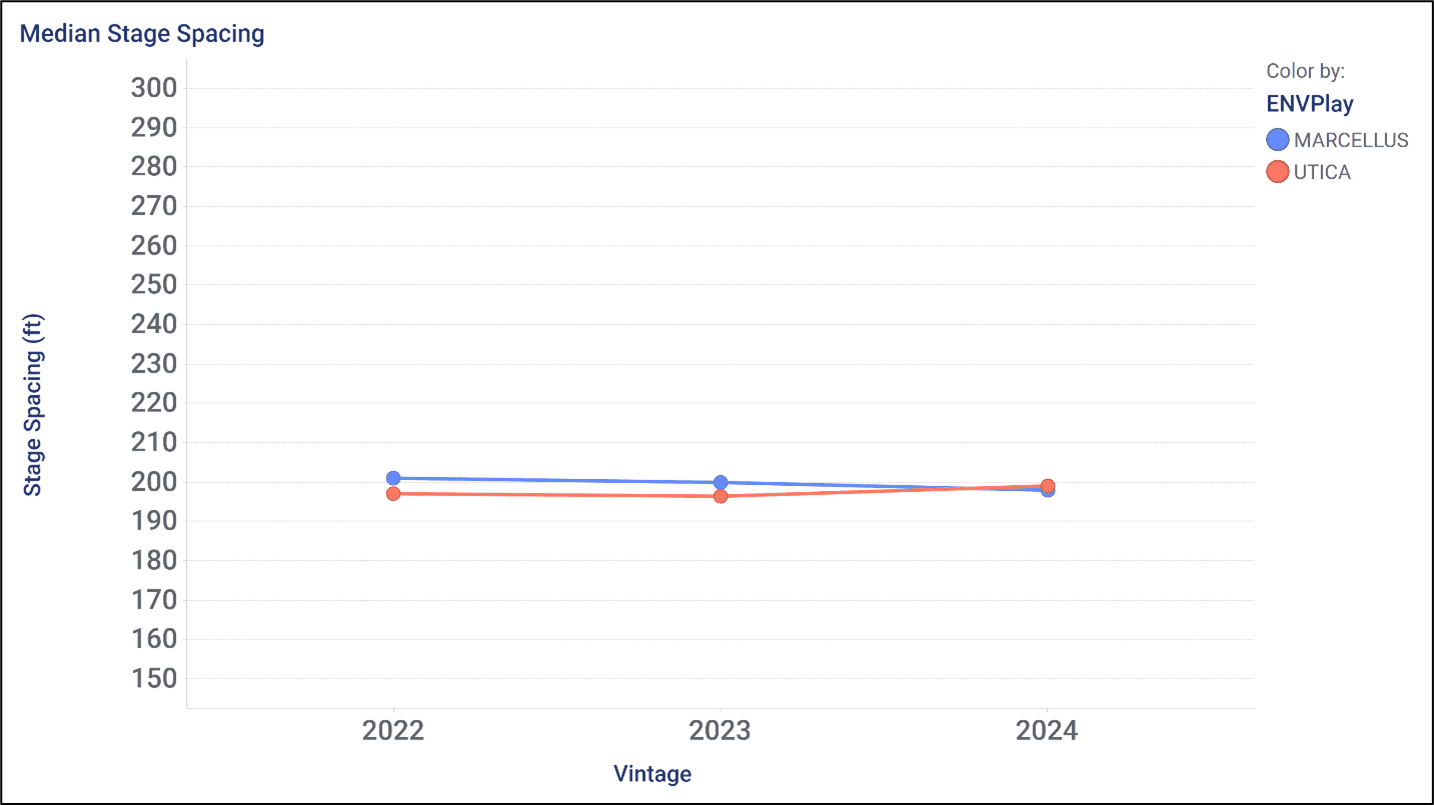

As the Appalachian shale plays matured, operators in the Marcellus and Utica have been focusing on optimizing completion designs. This includes increasing the number of stages per well, thereby reducing stage lengths to improve fracture coverage and reservoir stimulation. By 2022, operators appear to have reached a consensus around optimal average stage spacing. For the three years covered in this review, for both Marcellus and Utica, the median stage length is consistently very close to 200 feet per stage.

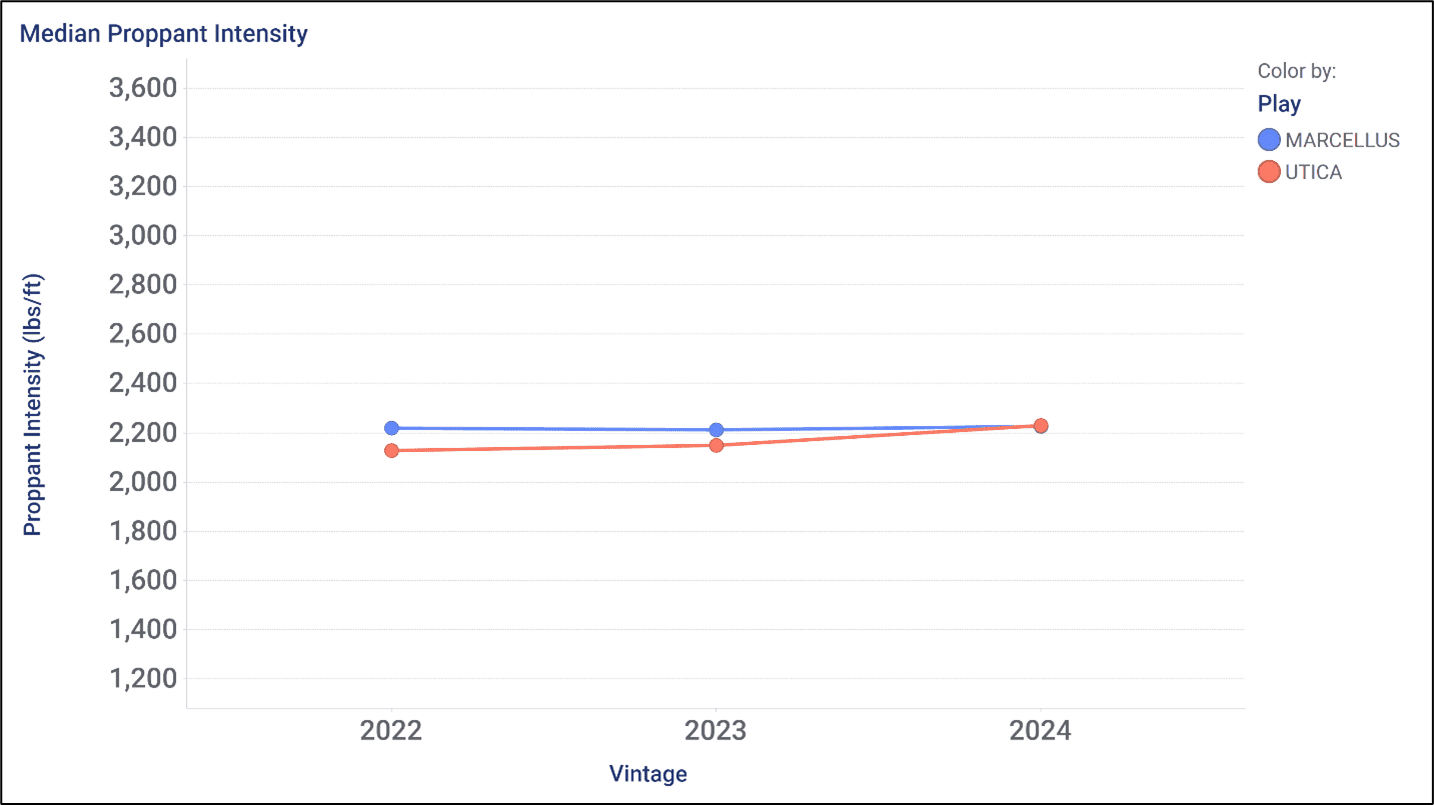

Another completion optimization metric that appears to have stabilized is proppant intensity. For the Marcellus, the median proppant intensity was just over 2,200 pounds per foot across the review period. In the Utica, median proppant intensity increased from 2,135 pounds per foot in 2022 to 2,230 pounds per foot in 2024, values very similar to the Marcellus.

Despite this stability, there is some indication of increased use of ultra-high-loading completions (exceeding 3,000 pounds per foot) in certain Marcellus wells, reflecting efforts to enhance well productivity. These ultra-high loading completions are primarily found in the West Virginia dry gas area and in northeastern Pennsylvania.

Recent trends in the Marcellus and Utica shales highlight a continued focus on maximizing well productivity and operational efficiency across the Appalachian Basin. Lateral lengths have steadily increased, pushing technical boundaries to over 24,000 feet in some cases, while completion designs have become more standardized—particularly in terms of stage spacing and proppant intensity. The data suggests operators have largely optimized these key parameters, though select areas are experimenting with more aggressive completion techniques to further enhance performance. As the basin continues to mature, we can expect incremental refinements, but the current trends point to a stable and disciplined development approach moving forward.

Source: Enverus. (2025). Appalachian Basin Well and Rig Activity Data. Accessed June 4, 2025, from https://www.enverus.com (Data subscription required)

Looking for trusted insight into U.S. shale development?

We offer expert reserves evaluations, technical consulting, and strategic guidance across the Lower 48. Whether you’re planning development, assessing acquisitions, or optimizing asset performance, our team delivers the clarity you need to move forward with confidence.

📩 Contact us at info@wrightandcompany.com

Please follow us on LinkedIn to stay up to date with the latest industry insights and contact us directly for a tried-and-true evaluation of oil and gas assets, large or small.