Written by Chris Sandwith

(Enverus Data Pulled 6-13-2024)

EOG Resources, Inc. (EOG) is one of the largest crude oil and natural gas exploration and production companies in the US. In fact, they are active in almost every major oil and gas basin throughout the continental US. It still came as a surprise, though, in their Q32022 earnings call when they announced their entry into the Utica shale play in Ohio. EOG has been actively developing the play since then and currently has two active drilling rigs in Ohio. However, EOG is not alone as Ascent Resources (Ascent) is the most active, currently running four rigs, followed by Encino Energy (Encino) with three rigs, and Gulfport Energy Corporation (Gulfport) and Infinity Natural Resources (Infinity) both running a single rig, per the latest data from Enverus. Let’s take a deeper dive.

The Utica Shale is one of the dominant hydrocarbon-bearing formations in the Appalachian Basin, along with the Marcellus Shale. The Utica lies deeper than the Marcellus but has started to get more attention as the number of top tier Marcellus locations has begun to dwindle. Extensive exploration of the Utica began in Quebec, Canada in 2006, whereas exploration in Ohio didn’t start until later in 2011. Depending on the location, the production from the Utica ranges from dry gas on the eastern edge to oil on the western edge, where EOG has been active.

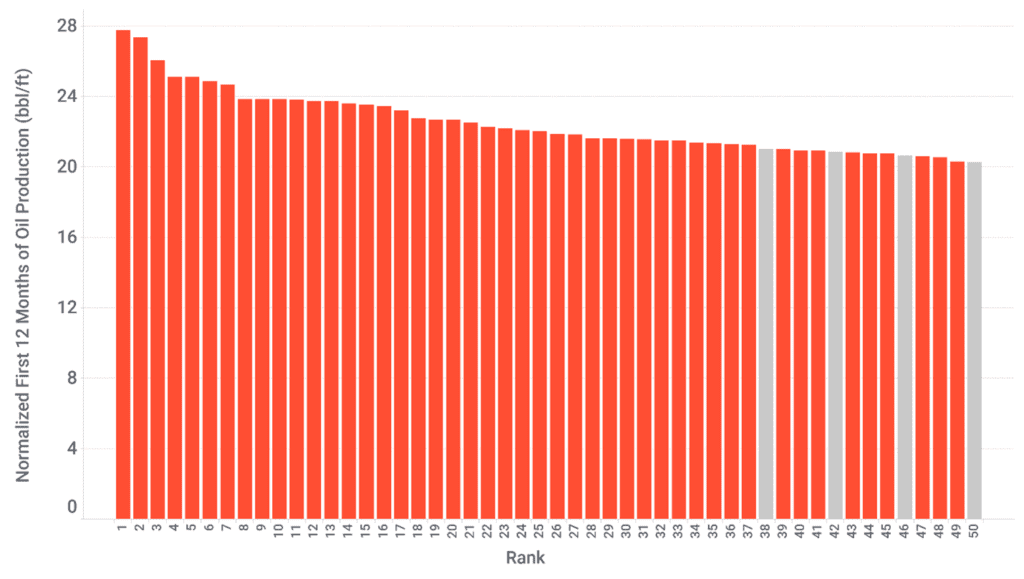

To aid in the discussion, we decided to normalize the initial production for the wells based on the lateral length reported by Enverus. This allowed for a more accurate comparison, as wells with longer lateral lengths would likely produce more oil than those with shorter lateral lengths.

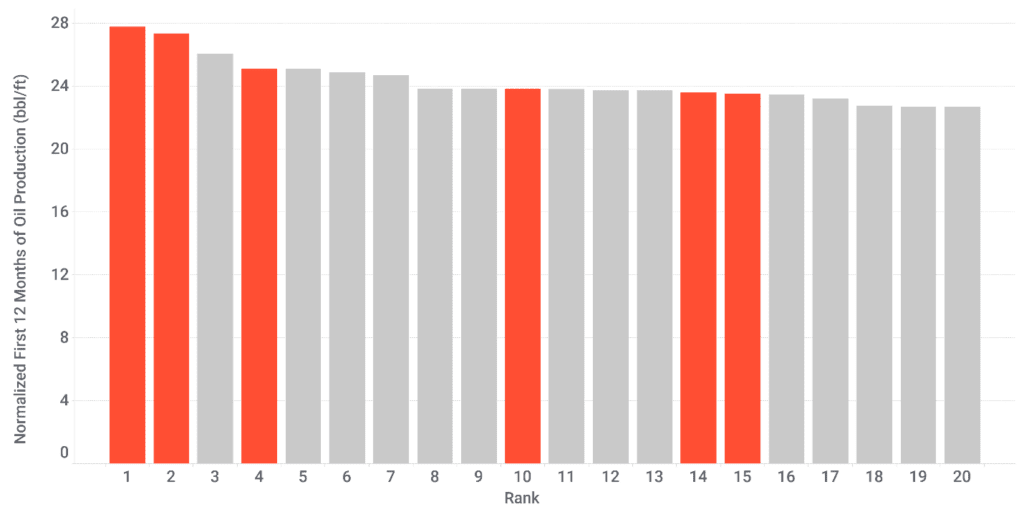

Historically, Ascent, Encino, and Southwestern Energy (Southwestern) have produced the best oil wells in Ohio when viewed through the lens of initial oil production. As shown above, these three companies operate all but four of the top 50 wells based on normalized first 12 months of oil production. Gulfport, EOG and Apache Corp. (APA) operate the other four wells. With the recent acquisition of Southwestern by Chesapeake Energy (Chesapeake), it will be interesting to see if Chesapeake increases activity in the play, as Southwestern had only drilled three wells in 2023, their first since 2019.

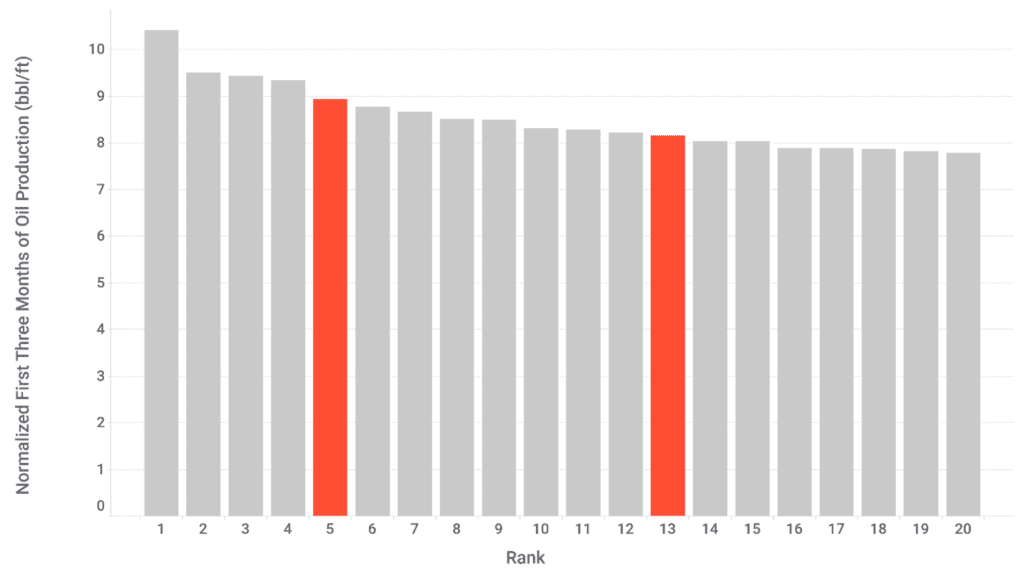

Looking at more recently drilled wells, EOG’s Xavier pad, which first began producing in Q4 of 2023, is showing promise early on.

When looking at the normalized first three months of oil production, two of the wells from this pad are within the top 20 of all Ohio Utica wells, and one of the wells has the second-most of all wells that first produced in 2023 with a normalized first three month oil production of approximately 8.93 barrels per lateral foot.

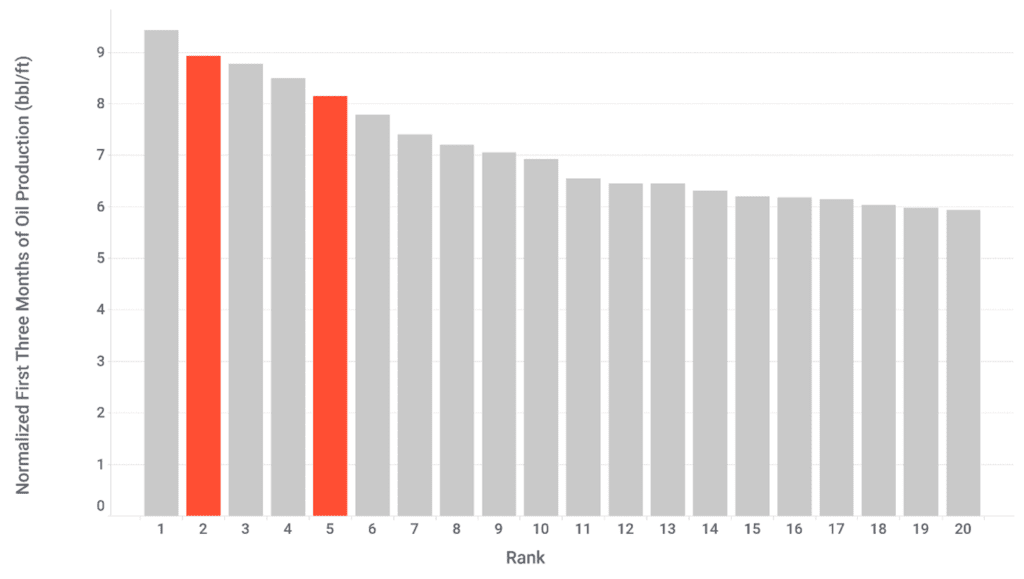

As EOG continues drilling additional pads in the Utica, we expect to see more wells push the bounds of the normalized first three months of production. It will also be interesting to see how quickly oil production rates decline, as some of the wells with high initial production rates in the first three months have experienced a significant decrease in production rate within the first 12 months. In fact, if you take the top 20 all-time Utica wells based on the normalized first three months of oil production, only six remain in the top 20 when comparing the normalized first 12 months of oil production, as shown below.

In their 1Q 2024 Investor Presentation (slide 13), EOG compared the normalized first 6 months of oil, gas, and liquids production of their Xavier pad and Timberwolf pad to some of the most productive counties in the Permian, and these early results demonstrate that the Utica oil play may be able to compete with the Permian. These early results look promising, and it will be interesting to see if the Utica oil play will maintain the stature of a premium play, not only outside of the early production phase, but as players like EOG continue to develop.

Please follow us on LinkedIn to stay up to date with the latest industry insights and contact us directly for a tried-and-true evaluation of oil and gas assets, large or small.