Written by Chris Sandwith

Is there hope for improved natural gas prices in the near future?

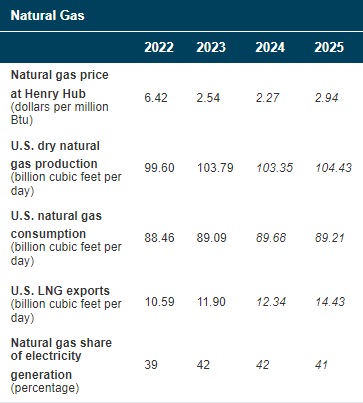

Since the calendar changed from 2023 to 2024, Henry Hub natural gas prices have been on a steady decline, and the EIA daily spot price has not risen above $2.00 per MMBtu since February 6th; however, as of March 20th, the 12-month average of NYMEX futures settlements (April 2024 through March 2025) is $2.709 per MMBtu. What caused such a depression in the price, and why is there optimism for prices to rise over the next year?

Potential Causes for Price Depression

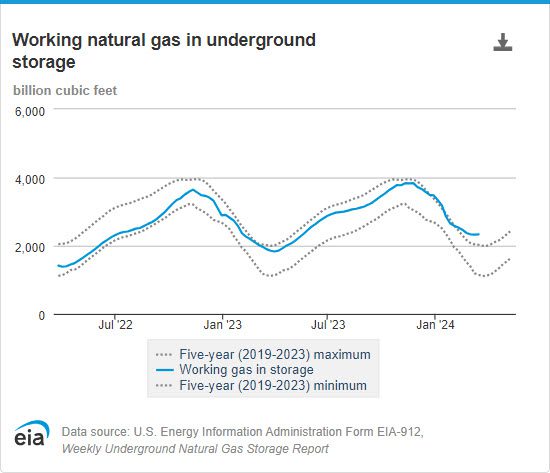

Gas prices are greatly affected by the supply of domestic operators and the demand of both domestic sources and international sources by way of liquified natural gas (LNG). As shown in the graph to the right, the working natural gas has been riding the high side of the five-year average curve, and in February, actually crossed over the curve. This shows that the demand for natural gas is less than the supply, causing more gas to be stored for future use.

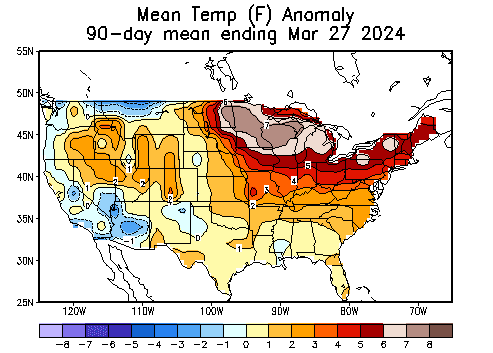

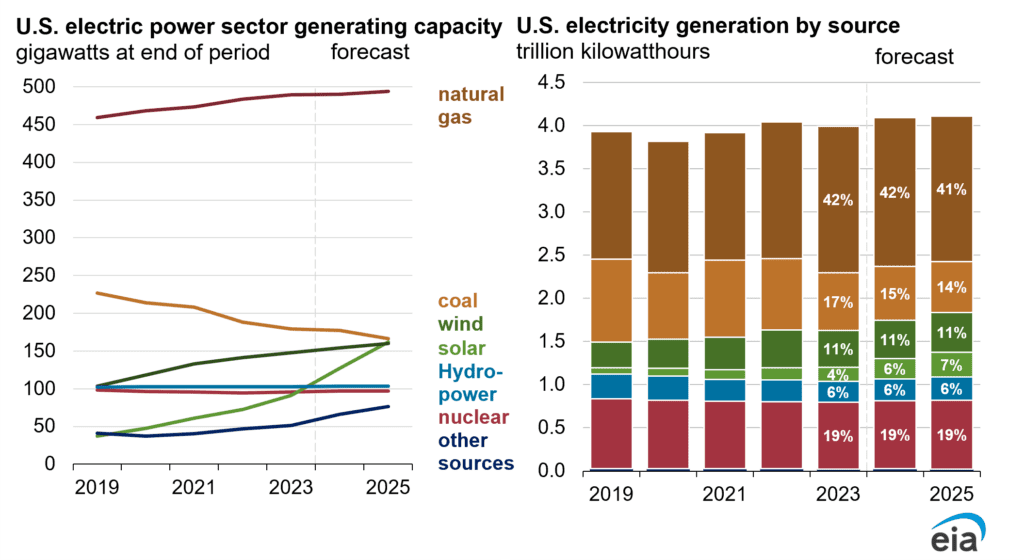

In 2023, the percentage of electricity generated using natural gas increased by 3% when compared to 2022, so the issue is not from moving away from the fuel. The majority of the influence on the demand seems to be from the mild winter experienced across the United States. As shown below, this map, sourced from the National Oceanic and Atmospheric Administration, is the mean temperature anomaly for the United States from December 27, 2023 to March 27, 2024. Many areas showed warmer winters, with a large swath of the Midwest and Northeast having temperatures five degrees warmer than average.

Furthermore, as reported by the EIA, there were 8% fewer heating degree days than the 10-year average, causing 9% less consumption than the previous five-year winter average, and an increase of 37% in inventory than the previous five-year average in March.

Also of note, oil prices have maintained a relatively steady price, hovering around $80 per bbl over the same timeframe. Due to associated gas production with oil, mainly in the Permian Basin, regional prices in some areas have ended up close to zero, and even negative.

To make matters worse for natural gas producers, on January 26, 2024, the Biden-Harris administration announced a pause on pending approvals of LNG exports to non-FTA countries.

Reason for Optimism

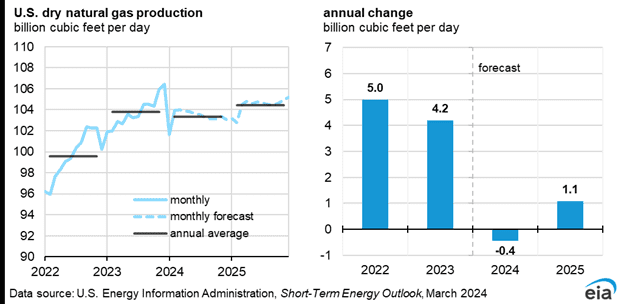

EIA predicts that natural gas production will remain relatively flat for 2024 and 2025 compared to production in 2023. This, coupled with increased future LNG exports, should cause an increase in prices across the board. In fact, natural gas operators have already announced that they will curtail their production in order to attempt to realize better commodity pricing.

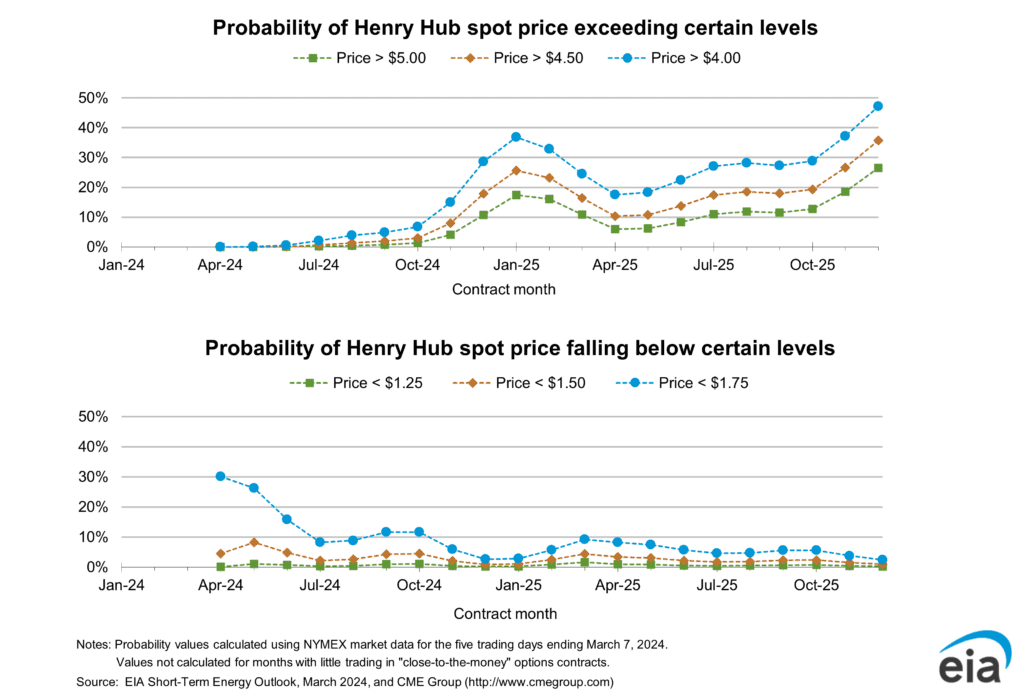

As shown by the EIA in the graph below, the probability that natural gas will be above $4.00 per MMBtu is more than 10 times greater than the probability it’ll be below $1.75 per MMBtu.

Although the current outlook is bleak, natural gas will continue to be utilized in power generation, especially as the US moves away from coal. The EIA expects over 40% of electricity to be generated from natural gas. Although the percentage is remaining essentially flat for 2024 and 2025, the total demand is expected to increase, meaning more natural gas is needed to meet demands.

For product price data, check out out our Product Prices Section. Please follow us on LinkedIn to stay up to date with the latest industry insights and contact us directly for a tried and true evaluation of oil and gas assets, large or small.